Five Clarifications On Cut Payment Collection Costs 50% Using IVR ACH Payments.

Cut payment collection costs 50% using IVR ACH Payments

Interactive voice response technology allows people to interact with telephones in an automated way. Businesses can leverage this technology to allow customers to pay invoices or amounts due without the need for a customer service agent to be on the phone.

ACH Payment Processing allows you to debit the customer’s checking or savings account for payments. Compared to credit card fees you are typically saving 80-90% plus. A business can utilize convenience fees and offer this solution at no cost to the business.

IVR payments technology doesn’t take vacation days and doesn’t call in sick. Always on 24/7/365. While there is a cost to implementing IVR for payment remittance, it’s significantly less expensive than your customer service agents staffing those calls. This reduction in man-hours offers bottom-line savings to the business. Think of those man-hours being spent in revenue generation tasks.

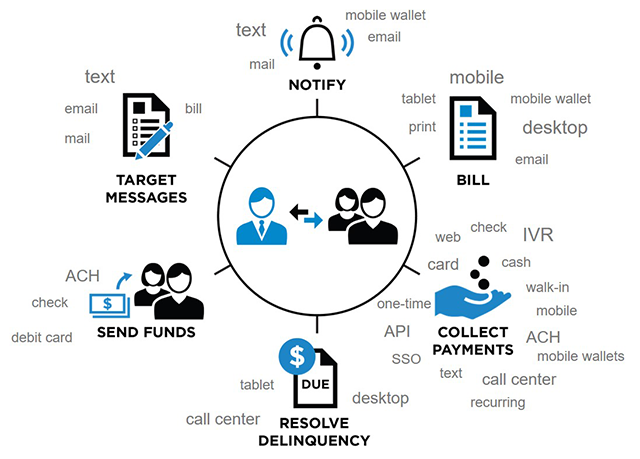

Now consider an automated ACH IVR Solution that works as follows:

After X days of payment being late, all customers past due receive automated outbound calls. “Dear Suzy Jones, this is County Waste calling. We have not received your payment of $48 due on the first. To make payment and continue your garbage pick up please press 1”

The customer is guided through voice prompts where any info the business is looking to collect is recorded. Payment is taken and a receipt can be emailed to that customer.

The business has complete visibility into all payments received on this payment channel.

Consider the time spent now on late payment collection. Remove manual labor and increase collection rates as people prefer anonymity when making late payments.

Another benefit of IVR payments comes in that callers don’t have to spend time on hold waiting for a customer service agent. Today’s IVR technology can support more calls than a company has callers. That leads to happier customers. Not only is there a benefit to customer service hour reduction, but the staffing hurdle for peak calling dates and hours is eliminated. Sure, there are times when there is a need for human customer service intervention, and today’s IVR technology can support that by programmatic configuration.

And then there’s the security benefit from ACH IVR Payments. When you eliminate human customer service agents from the equation of taking payment information, you eliminate a potential source of fraudulent use of sensitive data. Let’s face it; it only takes one disgruntled employee. Moreover, customers are simply more comfortable remitting their credit card or checking account information to an IVR system then someone at a call center.

ACH Payments has been supplying payment technologies for over 20 years. If you’re considering IVR ACH Payment Gateway for your organization, contact us to learn what we can do for you.